社区 发现 VAT&海外税务 安博VAT小讲堂-沙特VAT,中东卖家需...

安博VAT小讲堂-沙特VAT,中东卖家需要注意的税务问题

一、什么样的公司在什么条件下必须在沙特阿拉伯注册VAT呢?

关于什么样的公司销售额达到多少就必须要注册这个问题总是困扰着大家,也是卖家朋友们普遍的问题。请看下面,安博小编已经给大家总结好了,并配有沙特税局官方陈述:首先我们要从两个各角度讲:本地企业和海外企业

#沙特阿拉伯本地企业注册相关规定#

Mandatory Registration

All companies, businesses or entities which make an annual taxable supply of goods and services in excess of SAR 1,000,000 have been legally required to register for VAT by 20th December 2017.

However, all taxable persons whose annual taxable supplies exceed the mandatory Registration threshold of SAR 375,000 but do not exceed SAR 1,000,000 will be exempted from the requirement to register until 20th December 2018.

强制注册

所有公司年计税销售额超过1m SAR 在2017年12月20日是要求强制注册的。但是对于征税销售额在SAR 375,000-1m之间的可以宽限到2018年12月20。也就是说2018年12 月20日后强制注册。

Voluntary Registration

Those which make an annual taxable supply of goods and services in excess of SAR 187,500 are eligible for voluntary Registration. Voluntary Registration provides significant benefits for the companies since it allows the deduction of input tax.

自愿注册

对于年计税销售额超过 SAR187,500的公司可以自愿选择注册VAT,但是当然在进项税额抵扣方面,选择注册还是会给卖家公司带来很多好处的。

#海外企业注册规定(非沙特本地公司)#

Registration of taxable persons not Resident in Saudi Arabia

Non-Residents, who carry on economic activities but have no fixed place of business or fixed establishment in Saudi Arabia, are required to register if they have the obligation to pay VAT in Saudi Arabia.

All Non-Resident taxable persons must have one Tax Representative established in Saudi Arabia and who is approved by GAZT.

海外公司(在沙特无办公场所及固定机构)属于强制注册范畴必须制定一名当地的税务代表协助他们处理税务事宜与税局沟通。

二、必须由制定的税代注册

沙特要求海外公司的财务代表注册沙特VAT。财务代表与该海外公司负有连带责任,这意味着,如果该海外公司不支付VAT,则财务代表必须支付。

看到这里相信大家已经对沙特税局VAT注册的相关规定有了大概的了解,那么具体怎么注册呢?

沙特税局要求必须使用当局官方系统:

How should businesses register?

In order to register for VAT, businesses must first be registered at GAZT for Zakat and Income Tax.

如何进行VAT注册登记

沙特阿拉伯的VAT注册必须在官网GAZT系统上操作,并由税务代表提交完成。

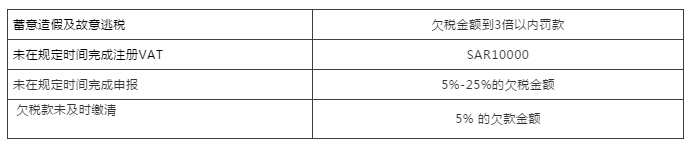

三、延迟或不注册将面临高额处罚。

如上所陈述,沙特需要税务代表附有连带责任,这就是为什么安博会定时提醒各位的申报,和再三催促您的缴税时间,关键沙特当局查处力度很非常大,具体处罚详情小编也给您总结了一下:

Failure to register for VAT in the specified timeframe will lead to a SAR 10,000 fine, in addition to other penalties due to failure to file VAT return in time and to pay VAT in time.

GAZT further clarified that the penalty for failure to pay VAT in time is 5% of the VAT due for each month. Failure to file VAT return in time will result in a fine of no less than 5% and not more than 25% of the VAT due. In addition, VAT due on late registered businesses will be calculated from the date of VAT implementation on January 1st, 2018, as all penalties and fines will be effective from this date.

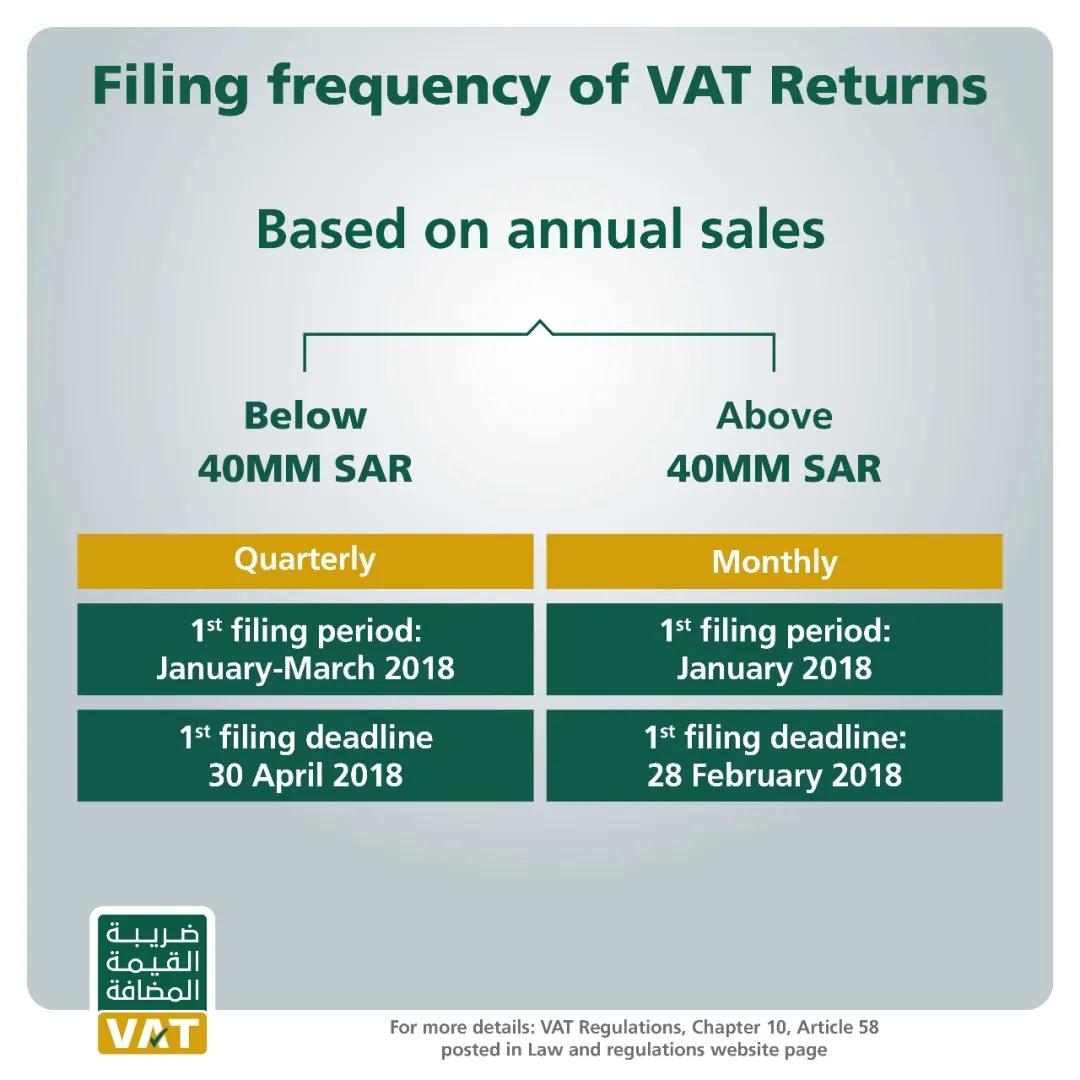

四、谁需要申报,何时申报

Who files VAT returns and when?

Taxable persons which make an annual taxable supply of goods and services in excess of SAR 40,000,000 are required to file VAT returns monthly.

All other taxable persons are required to file VAT returns quarterly. However, such persons may elect to file monthly returns subject to approval by GAZT.

From the end of the tax period (as defined above) all taxable persons will have one month to file their VAT return. For example:

If monthly returns are required, for the tax period 1 January 2018 to 31 January 2018 the VAT return must be filed by 28 February 2018

If instead quarterly returns are required, for the tax period 1 January 2018 to 31 March 2018, the VAT return must be filed by 30 April 2018

与阿联酋一样,沙特从2018年1月1日起开始征收VAT,税率为5%。增值税退税是每季度一次,一旦销售额达到4000万,就必须每月申报增值税。

具体申报日期还是要看您的年应税销售额来定,40m以下的,第一次需要申报一月到三月的,申报截止日期为4月30日。如果应税销售额在40m以上的,第一次需要申报一月份的,以此类推,并且申报截止日期为2月28日。这边需要强调的是沙特VAT与阿联酋一样是从2018年开始执行的,所以第一次申报其实也是从2018年1月开始的,但是我们接下来就按照要求定时按季按月申报就好。

*更多的VAT知识,请继续关注安博会计事所的VAT小课堂~下期再见。

倒计时:

倒计时:

4 个回复

xyz1611 - 80后水瓶女子

赞同来自: 星野爱